payment service provider business

eComCharge is certified as an official Visa token requestor

On October 5, 2021, eComCharge successfully completed certification and acquired the status of a Visa token requestor in CEMEA. Since May 2020, eComCharge has officially been a member of the global Visa Digital Enablement Program (VDEP).

Payment service providers who lease the beGateway payment platform are already able to use the global token from Visa when working with acquiring banks that participate in the Visa Digital Enablement Program (VDEP).

Mobile SDKs for Android and iOS in the beGateway white label payment platform

If you are a payment service provider who rents the beGateway white label payment platform for payment accepting and processing under your own brand, you are most interested in the platform’s functionality. Today we want to talk about SDKs (Software Development Kit) for Android and iOS for accepting payments in sellers’ mobile apps.

Why do we need mobile SDKs for Android and iOS?

See you at the Oman E-Commerce Conference (OEC 2019| September 16th-17th)

Our white label payment gateway beGateway is rented by completely different businesses from different parts of the globe. Next week we will fly to Oman to attend the Oman E-Commerce Conference (OEC 2019| September 16th-17th).

According to the organizers of the conference “The Oman E-Commerce Conference – OEC 2019, hosted by the Ministry of Commerce and Industry from the Sultanate of Oman, The Most innovative ecommerce conference accelerating digital economy with one focus “Everything Online””.

Setting limits on transactions. Recommended or required for a processing company?

Setting limits on transactions to be processed so that the business of the processing company could be successful does sound strange to third-party people. It would seem that the more transactions the payment service provider processes, the bigger the commission it will receive from the customers. And the limits seem to hinder the growth of the business of the payment company. Nevertheless, the system of limits is part of the control over the transactions performed by the processing company and serves as an important means of maintaining stability and security of the business.

Usually, online merchants do not know it, but international payment systems (VISA, Mastercard and others) recommend payment service providers to limit the number of accepted payment transactions carried out using the same bank card through the same merchant account (i.e. online store or mobile application) within one day. These recommendations vary depending on the type of online business.

What do I need to know about financial institution licenses for Payment Service Providers?

For a payment company, PI or EMI authorization today means months of expectations. We talked to the customers of eComCharge (white Label Payment Gateway tenants) who have already received European licenses, and who also await obtaining one in other jurisdictions, and here is a review for those who just thought about it. Naturally, it is not a very detailed one, as authorization requires a lawyer.

The most popular types of payment licenses in Europe

To date, European payment companies covet one of the two authorization types relating to the Financial Institution and issued under the PSD2 regulation: PI (Payment Institution) and EMI (Electronic Money Institution).

Anti fraud management system and tools for the white label payment gateway beGateway

The importance of anti fraud management system and fraud protection tools to protect online sellers from fraudulent payments in e-Commerce is huge. Unlike traditional trade, the Internet merchant accepting payments over the Internet can only hope that the person on the other side of the monitor is indeed the owner of the bank card and a conscientious buyer.

The payment data that the buyer enters on the payment page of the online store or mobile application is easy to steal, copy and use. To protect against fraudulent transactions, white label payment gateway beGateway offers its tenants three integrated fraud protection tools. Moreover, we also offer a possibility to connect any third-party instrument at the request of the payment service provider.

White Label Payment Processing Platform: review of the new payment widget with 3-D Secure check

eComCharge developers released a new payment widget for the white label payment processing platform beGateway with the ability to pass 3-D Secure check in the widget. Here are the advantages beGateway tenants and their clients gained.

A payment widget is a payment form opened on the website in an iframe to keep a visual contact of the online buyer with the website on which they pay for a product or service, without redirection to the page of the electronic payment processor.

White Label Payment Gateway feature: simple integration of merchants to the payment service via the payment module

In the early 2000s, connecting a website to a payment service provider usually required certain programming skills from merchants. Back then, the merchants hired programmers to tackle the program code that was supposed to link the online store and the processing system (through which the merchant intended to accept payments from their customers). Today everything has changed. For the merchant to connect quickly to your processing system, he just need to download a payment module for his shopping cart from your Github.

eComCharge (beGateway) partners with most of the popular online shopping carts for simple integration yours merchants with beGateway white label payment gateway.

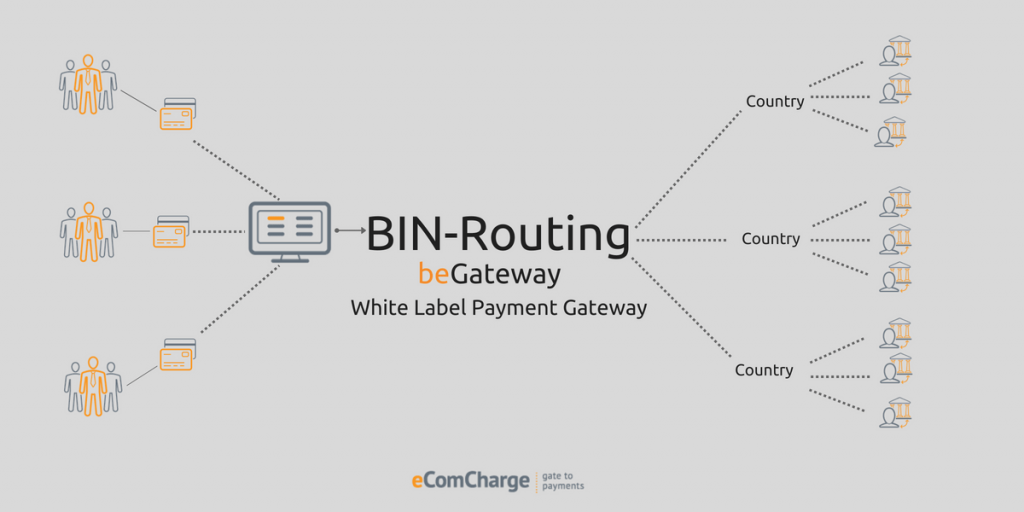

How will BIN-routing reduce cost for white label payment gateway tenants?

In the summer of 2018, the eComCharge team has enhanced its SaaS white label payment platform beGateway with another functionality. We have added BIN-routing – automatic routing of card transactions to the desired acquiring bank depending on the card BIN (Bank Identification Number). This functionality is part of SMART-routing which the team is planning to implement in the near future.

Thanks to the new functionality, the cost of Internet acquiring for the tenants of the white label payment gateway has decreased on average by 0.6%. It is because processing companies can now direct payment card transactions for processing to the acquiring banks for which these transactions are Intraregional, Domestic or even On-us.

Anti-fraud system for the white label payment solution beGateway

Today the White Label Payment Solution beGateway offers payment service providers three options of fraud protection: 3-D Secure, beGateway and minFraud (MaxMind) that are able to integrate with any other processing system.

1. 3-D Secure is the official payer verification technology, aka Verified by Visa, and MasterCard SecureCode.

2. MinFraud is a tool for detecting network fraud from the MaxMind company.

3. beProtected is a fraud protection and risk management system developed by the eComCharge team. beProtected can work with beGateway as well as any other payment gateway of the payment service provider if the latter requires fraud protection.