Setting limits on transactions to be processed so that the business of the processing company could be successful does sound strange to third-party people. It would seem that the more transactions the payment service provider processes, the bigger the commission it will receive from the customers. And the limits seem to hinder the growth of the business of the payment company. Nevertheless, the system of limits is part of the control over the transactions performed by the processing company and serves as an important means of maintaining stability and security of the business.

Usually, online merchants do not know it, but international payment systems (VISA, Mastercard and others) recommend payment service providers to limit the number of accepted payment transactions carried out using the same bank card through the same merchant account (i.e. online store or mobile application) within one day. These recommendations vary depending on the type of online business.

Some acquiring banks put forward such recommendations as mandatory conditions. As a result, they require that payment service providers should be able to set limits on their online payment acceptance and processing systems when working with bank cards.

Types of limits. Examples.

The introduction of limits on transactions does not always happen under the pressure from the acquiring bank. Processing companies are willing to use payment processing restrictions on their own initiative.

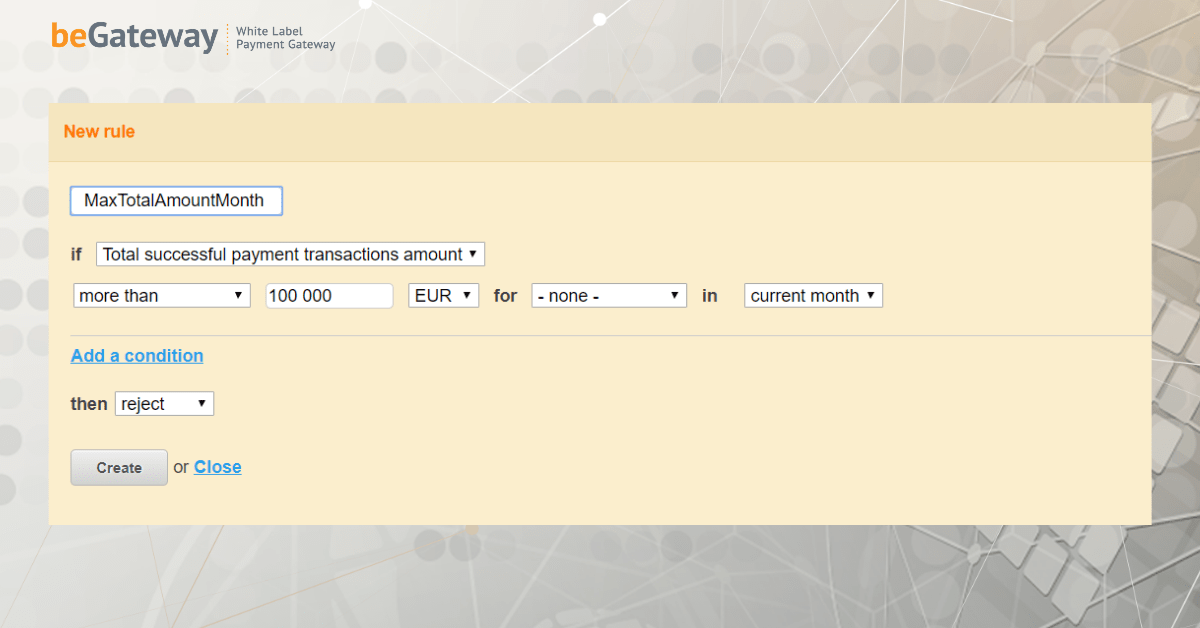

For example, if a processing company provides services for accepting card payments over the Internet to high-risk merchants, it sets a limit for the maximum total amount of payment transactions that an online merchant can accept through a payment processing system for a given period of time (typically one month). Such restrictions are usually set for each high-risk merchant on an individual basis.

Limits may be revised and changed over time. The main task of the processing company is to maintain control over the Internet seller’s chargebacks. Some payment service providers prefer to set limits on the total amount of monthly payments accepted for the merchant account in their system as a whole, rather than for each of the merchant’s online stores separately (if a seller has more than one online store).

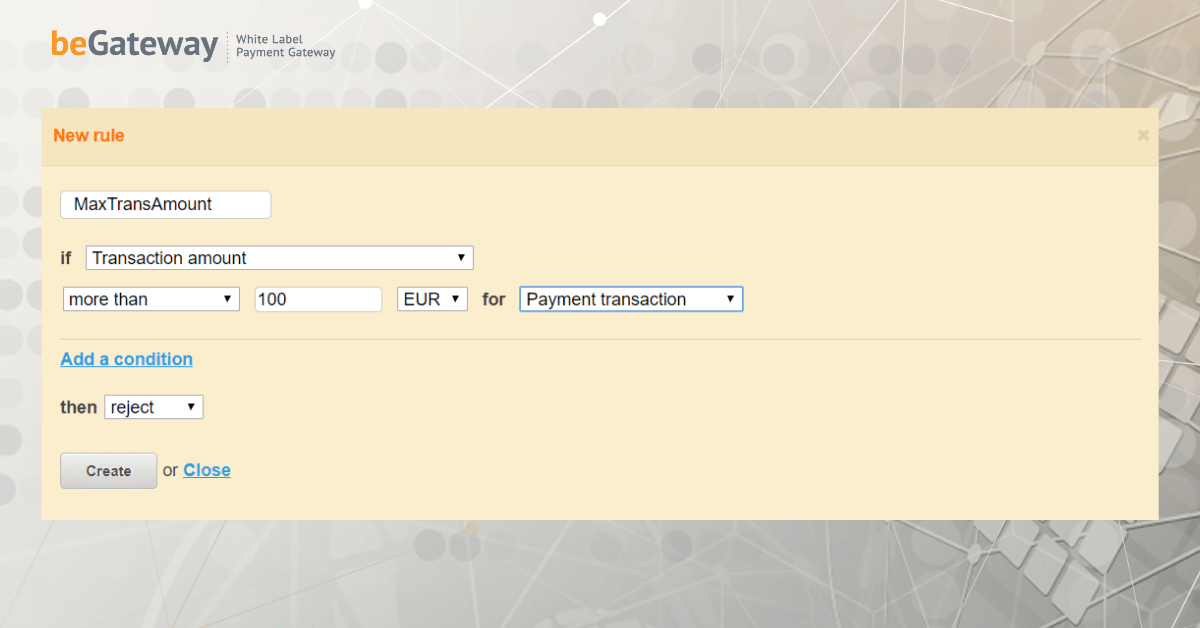

Another popular limitation used by payment service providers is the limit on the amount of an individual transaction. Usually, the online store sets the maximum allowable amount of payment to receive, and the processing system of the payment service provider rejects any transaction with an amount exceeding the specified value.

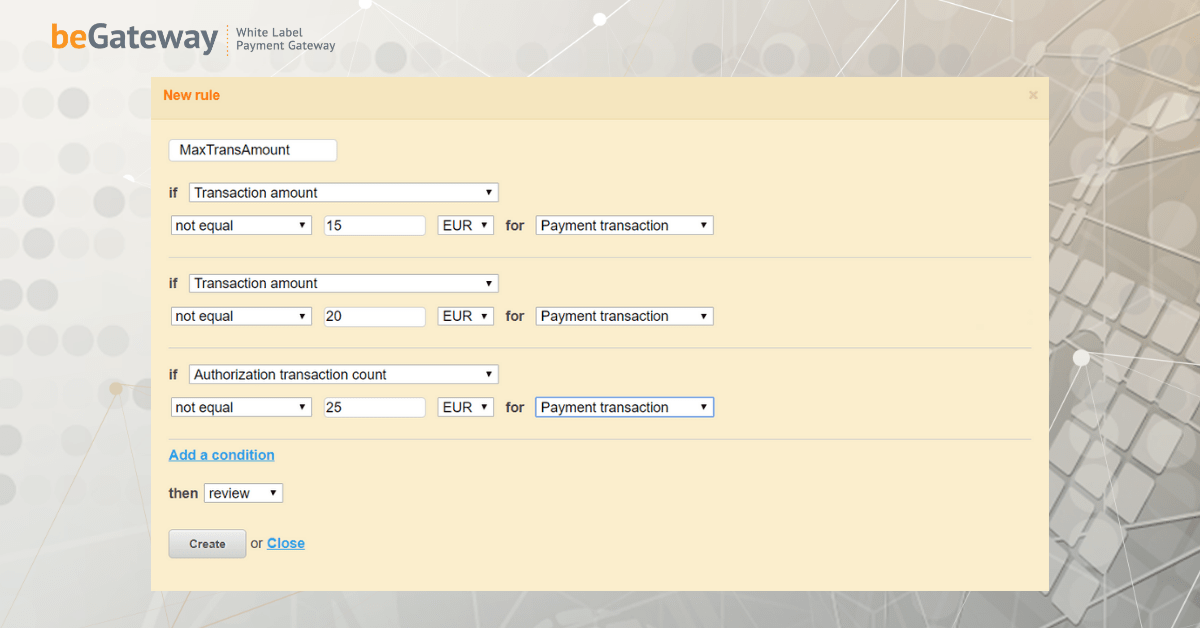

There is another limit, though used less frequently, in which the payment service provider creates a list of allowed transaction amounts for the online store or the online merchant overall, and the processing system can only accept payments and amounts that match those specified in the list. If the software of the payment acceptance and processing system can send customized notifications to your risk managers, such restrictions help the processing company to quickly and effectively detect attempts of illegal payment aggregation by unscrupulous online merchants.

What features should payment software of a processing company have?

Among the most important features that a payments acceptance and processing system should have, are the following:

- The ability to set restrictions in the system of acceptance and processing of online payments for the online merchant and their stores by the type, number and amount of transactions allowed to receive;

- The ability to permit to process them based on their characteristics, along with the ability to send customized notifications to risk managers of the payment service if necessary.

The adequate limits on the maximum number of refunds and chargebacks that an online store can relatively safely process during one day or one month, together with an appropriately configured notification system will help the payment service provider to immediately find out about possible problems in case the specified limits are exceeded, and to take measures to minimize their consequences as soon as possible.

A ban (or vice versa permission) to process a payment depending on one or several characteristics of its transaction allows you not only to create and manage the so-called “black” and “white” lists of buyers and customers of online merchants, but also to set up flexible scenarios, indicating to the processing system of the payment service provider which payment transactions are to be accepted or to be rejected.

As a software developer for online payment service providers, we at eComCharge understand the needs of our customers. Therefore, our white label payment gateway and processing platform beGateway that any online payment service provider can use to get their own modern full-featured system for online payment acceptance and processing, offers virtually unlimited possibilities for creating and managing any transaction limits for a stable and secure business of both the processing company and their customers.