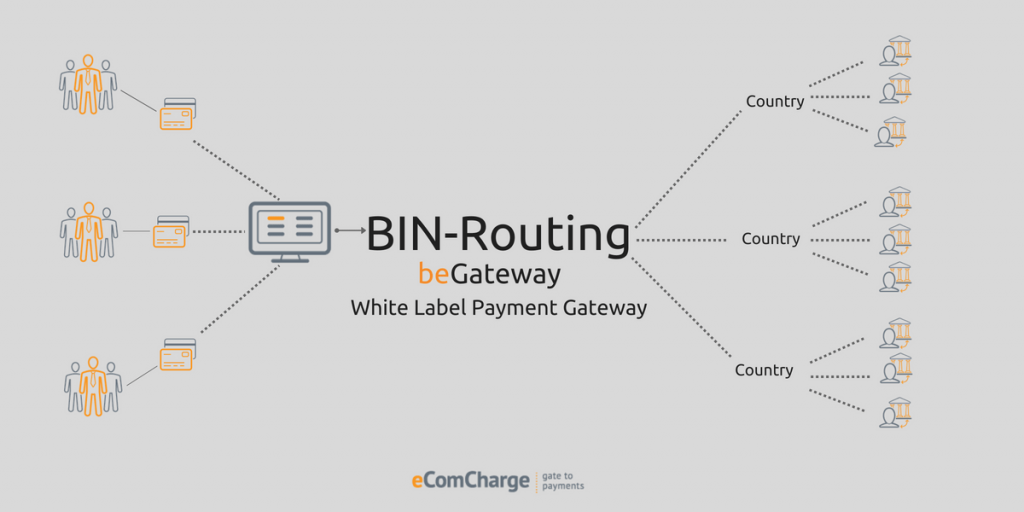

In the summer of 2018, the eComCharge team has enhanced its SaaS white label payment platform beGateway with another functionality. We have added BIN-routing – automatic routing of card transactions to the desired acquiring bank depending on the card BIN (Bank Identification Number). This functionality is part of SMART-routing which the team is planning to implement in the near future.

Thanks to the new functionality, the cost of Internet acquiring for the tenants of the white label payment gateway has decreased on average by 0.6%. It is because processing companies can now direct payment card transactions for processing to the acquiring banks for which these transactions are Intraregional, Domestic or even On-us.

Perhaps this figure may not look very impressive, but the law of large numbers changes the first impression. With a monthly turnover of €10 million, a business can save up to €60,000 on the cost of card payment acceptance. For a payment aggregator, the same turnover will bring additional €60,000 of monthly profit.

It is best explained by giving an example.

How to determine payment processing cost for processing companies

It is an open secret that the cost of payment processing in Internet acquiring is largely determined by the type of payment transaction. There are four transaction types that determine the size of the Interchange fee, i.e. the interbank remuneration received by the issuing bank each time its card is used as a means of payment in a transaction processed by the acquiring bank.

The interchange fee is incorporated in the acquiring bank commission to be paid by the Internet-seller (merchant). The value of the interchange fee is established by the payment system (VISA, MasterCard, etc.), both the issuing and the acquiring bank being members of the same system. The payment system determines the tariffs for Internet acquiring for sellers and for payment aggregators.

Here are transaction types in ascending order of the interchange fee:

- On-US transaction, i.e. the same bank is both the issuer of the payment card and the acquiring bank that processes the payment made with this card. In this case, the interchange fee is not charged.

- Domestic transaction, i.e. the issuer and the acquirer are located within the same country. Depending on the payment system, the fee may vary from 0.2% of the payment amount to 1% and more.

- Intraregional transaction, i.e. the issuer and the acquiring bank are located in different countries, but within the same geographical area established by the payment system. In this case, the interchange fee varies on average from 0.6% of the payment amount to 1% and more.

- Interregional transaction, i.e. the issuer and the acquirer are located in different geographical zones. The interchange fee for such transactions is the highest.

BIN-routing: examples

Example 1. Online Shop

Let us take an online shop with the bulk of sales in the EU and the USA. This shop is connected simultaneously to two acquiring banks through the payment service provider leasing the processing platform beGateway. One acquiring bank is in the EU, the other is in the USA.

Thanks to the new functionality of the beGateway processing platform, the processing company configures the online shop transaction routing so that transactions with cards issued by the EU banks are sent for processing to the European acquiring bank. While transactions with American bank cards are sent to the US acquiring bank.

When the buyer enters the card number on the payment page of the online shop, the processing platform beGateway determines the issuing bank and the country where it is located by the card BIN, and automatically directs the transaction to the appropriate acquiring bank to process the payment.

This approach is advantageous for both the payment service provider and the online shop.

The payment service provider is able to offer online shops card payment acceptance at lower tariffs without reducing its own margin, which is an obvious competitive advantage.

The internet shop gets an opportunity to optimize and reduce its own expenses for card payment acceptance, and thus to increase the profit.

Example 2. Payment aggregator

Let us take a payment service provider that offers card payment aggregation service. Internet shops from different countries of the world are connected to it. However, the main amount of payments involves bankcards from the EU, the USA, Russia and Asian countries.

The new functionality of the beGateway white label payment processing platform enables the processing company to configure the transaction routing so that each transaction is Intraregional or Domestic for the chosen acquiring bank. Moreover, within one country, e.g. Russia, a payment service provider can set up transaction routing so that most of transactions are On-us for the respective Russian acquirers, which simultaneously are the largest Russian issuers. Of course, if cooperation agreements are signed between the payment service provider and the acquiring banks.

In this case, the customizable transaction BIN-routing, offered by the SaaS white label payment gateway platform beGateway, allows the tenant to reduce the cost of card payment processing significantly. Which in turn enables the processing company to increase its own profit and offer more attractive tariffs to the most valued merchants.