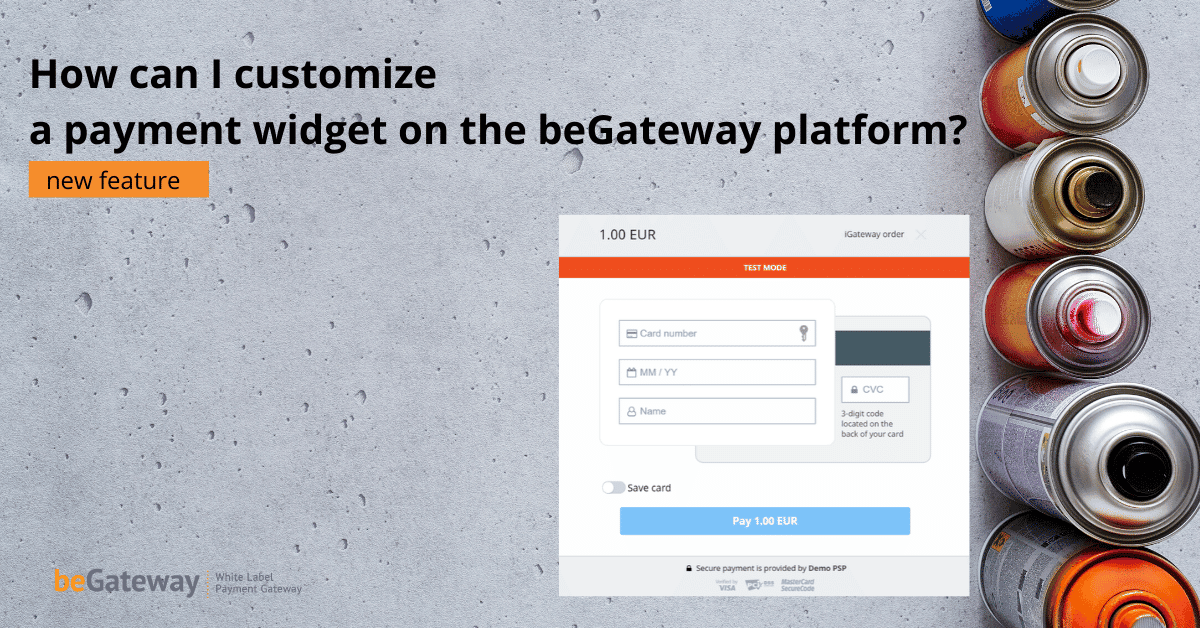

How can I customize a payment widget on the beGateway white label payment platform?

Last year, we announced our new payment widget with 3-D Secure inside for the tenants of the beGateway white label payment gateway solution. One widget to combine all payment means for a merchant to receive payments.

To see a basic widget and to view how it works, please visit our page “Payment widget“: Read more…

Mobile SDKs for Android and iOS in the beGateway white label payment platform

If you are a payment service provider who rents the beGateway white label payment platform for payment accepting and processing under your own brand, you are most interested in the platform’s functionality. Today we want to talk about SDKs (Software Development Kit) for Android and iOS for accepting payments in sellers’ mobile apps.

Why do we need mobile SDKs for Android and iOS?

Setting limits on transactions. Recommended or required for a processing company?

Setting limits on transactions to be processed so that the business of the processing company could be successful does sound strange to third-party people. It would seem that the more transactions the payment service provider processes, the bigger the commission it will receive from the customers. And the limits seem to hinder the growth of the business of the payment company. Nevertheless, the system of limits is part of the control over the transactions performed by the processing company and serves as an important means of maintaining stability and security of the business.

Usually, online merchants do not know it, but international payment systems (VISA, Mastercard and others) recommend payment service providers to limit the number of accepted payment transactions carried out using the same bank card through the same merchant account (i.e. online store or mobile application) within one day. These recommendations vary depending on the type of online business. Read more…

Anti fraud management system and tools for the white label payment gateway beGateway

The importance of anti fraud management system and fraud protection tools to protect online sellers from fraudulent payments in e-Commerce is huge. Unlike traditional trade, the Internet merchant accepting payments over the Internet can only hope that the person on the other side of the monitor is indeed the owner of the bank card and a conscientious buyer.

The payment data that the buyer enters on the payment page of the online store or mobile application is easy to steal, copy and use. To protect against fraudulent transactions, white label payment gateway beGateway offers its tenants three integrated fraud protection tools. Moreover, we also offer a possibility to connect any third-party instrument at the request of the payment service provider. Read more…

White Label Payment Processing Platform: review of the new payment widget with 3-D Secure check

eComCharge developers released a new payment widget for the white label payment processing platform beGateway with the ability to pass 3-D Secure check in the widget. Here are the advantages beGateway tenants and their clients gained.

A payment widget is a payment form opened on the website in an iframe to keep a visual contact of the online buyer with the website on which they pay for a product or service, without redirection to the page of the electronic payment processor. Read more…

White Label Payment Gateway feature: simple integration of merchants to the payment service via the payment module

In the early 2000s, connecting a website to a payment service provider usually required certain programming skills from merchants. Back then, the merchants hired programmers to tackle the program code that was supposed to link the online store and the processing system (through which the merchant intended to accept payments from their customers). Today everything has changed. For the merchant to connect quickly to your processing system, he just need to download a payment module for his shopping cart from your Github.

eComCharge (beGateway) partners with most of the popular online shopping carts for simple integration yours merchants with beGateway white label payment gateway. Read more…

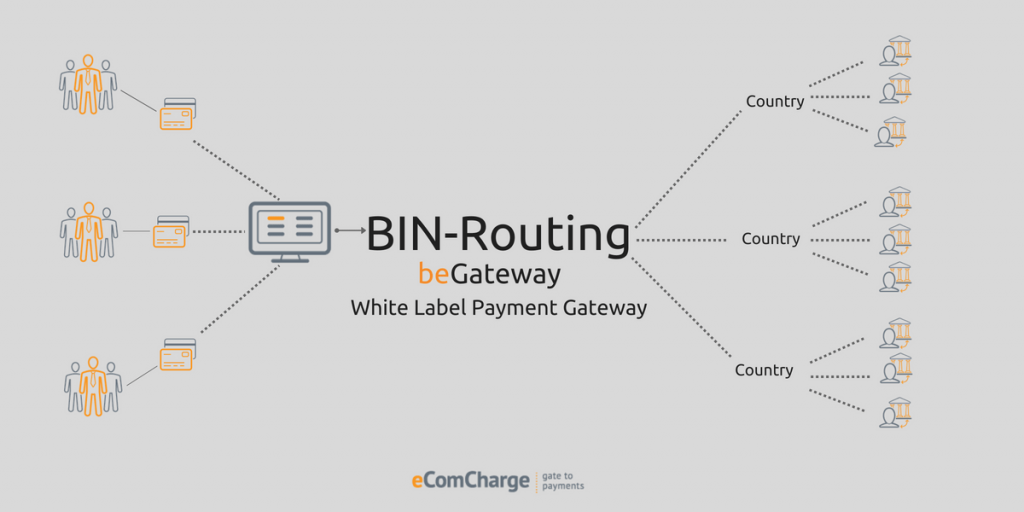

How will BIN-routing reduce cost for white label payment gateway tenants?

In the summer of 2018, the eComCharge team has enhanced its SaaS white label payment platform beGateway with another functionality. We have added BIN-routing – automatic routing of card transactions to the desired acquiring bank depending on the card BIN (Bank Identification Number). This functionality is part of SMART-routing which the team is planning to implement in the near future.

Thanks to the new functionality, the cost of Internet acquiring for the tenants of the white label payment gateway has decreased on average by 0.6%. It is because processing companies can now direct payment card transactions for processing to the acquiring banks for which these transactions are Intraregional, Domestic or even On-us. Read more…

Anti-fraud system for the white label payment solution beGateway

Today the White Label Payment Solution beGateway offers payment service providers three options of fraud protection: 3-D Secure, beGateway and minFraud (MaxMind) that are able to integrate with any other processing system.

1. 3-D Secure is the official payer verification technology, aka Verified by Visa, and MasterCard SecureCode.

2. MinFraud is a tool for detecting network fraud from the MaxMind company.

3. beProtected is a fraud protection and risk management system developed by the eComCharge team. beProtected can work with beGateway as well as any other payment gateway of the payment service provider if the latter requires fraud protection. Read more…

How many transactions per second should the white label payment gateway platform handle?

When you rent or buy a white label payment gateway, pay attention to such a critical feature as the throughput capacity of transactions.

The throughput capacity indicates how many transactions a payment gateway can process per unit of time (usually 1 second). Read more…

How long does it take to install, configure, and launch the white label payment gateway for the payment service provider? How to accelerate it.

To handle online payments for merchants, modern processing companies need a modern payment gateway with a satisfactory set of functionalities. It can either be developed independently, which means hiring a team of developers, investing a couple of thousands of hundreds of euros and spending at least one year on the simplest version development. You can also buy a ready-made processing system. Or, rent a white label payment gateway with technical support and subsequent purchasing of the code, which is the least costly and sometimes the most advantageous solution for most payment companies.

If you opt for renting or buying a ready-made payment gateway as a White Label Solution, let’s talk about the launch time of its commercial operation. Read more…