Unlock New Opportunities with beGateway: Visit Our Booth at FINTEX SUMMIT 2023!

We’re thrilled to announce our participation at FINTEX SUMMIT 2023 – FINANCE AND TECHNOLOGIES EXPO, taking place in Azerbaijan on June 13-14, 2023!

Join us at our booth, where eComCharge UAB, a leading provider of white label payment solutions, will showcase our cutting-edge White Label Payment Processing Solution beGateway. This event is a perfect platform for banks, acquiring partners, and payment service providers (PSPs) to explore new opportunities and unlock their full potential.

We invite all attendees to meet our esteemed experts, Chief Product Officer Alexander Mihailovski and Business Development Manager Polina Kirova. They will be available at our booth to discuss how our innovative White Label Payment Processing Solution can revolutionize your business.

Don’t miss this chance to connect with us, learn about the latest industry trends, and discover how we can empower your organization with seamless white label payment software beGateway. See you at FINTEX SUMMIT 2023 – Finance and Technologies Expo!

How to get the beGateway payment platform?

beGateway is the white-label payment platform developed and supported by eComCharge UAB. eComCharge offers the beGateway payment platform for PSPs who need to get payment gateways and payment processing systems under their own brand names.

Choose an option that suits you. Read more…

Who is the client of the beGateway payment platform

“70% of our tenants are PSPs serving high-risk merchants”

Alexander Mihailovski, СPO of eComCharge UAB, explains to whom he and his team have been leasing branded payment gateways and online payment processing systems built on the beGateway payment platform for 8 years.

When we started offering the beGateway payment platform for those who need to get payment gateways and payment processing systems under their own brand names, we identified three large segments that might be interested in our software:

- Payment service providers who need the appropriate software.

- Acquiring banks that plan to create an in-house payment service provider.

- Large merchants who need their own payment processing software to route and manage transactional flows of their business when dealing with a large number of payment service providers.

We do our best to promote the beGateway platform in all designated segments at once. We have achieved the greatest success in the first one. Today, 90% of customers of the beGateway payment platform are payment service providers.

At the same time, the main tenants of the beGateway payment platform (70% of the total number of our clients) are payment service providers who work in the high-risk niche such as gambling, forex, online casinos, etc.

Such processing companies, as a rule, are created by people with experience in this particular niche. Usually, they come from banks serving high-risk merchants, or they can be agents who successfully work with online casinos and generate traffic for their customers, or they may introduce large merchants to various acquiring banks, etc. At some point, they decide to start their own payment processing business in order to make money on high margin services. As a rule, they already have an established customer base, connections with acquiring banks, but they do not have their own payment gateway and processing system that could link their merchants and the acquiring banks. They rent software of a payment gateway and online payment processing system from us and eventually receive their own branded payment gateways and turnkey processing systems.

The remaining almost 30% of our tenants are processing companies serving low or medium-risk merchants.

Since 2016, there has been an acquiring bank among our clients of the beGateway platform. This is a bank that was looking for a technical solution to connect its own merchants quickly and conveniently.

We are now negotiating with another bank and a company from South Africa that have been successfully operating in the retail acquiring market for a long time. Both of them are planning to enter the Internet acquiring market and are interested in the possibilities of our beGateway platform in order to offer their own branded payment gateways to their customers who need the Internet acquiring services.

Unfortunately, there have been no representatives of our third segment among the clients of the beGateway platform yet. Experience has shown that promoting the beGateway platform for payment service providers and for merchants should be different. In addition, merchants often need less functionality. Our immediate plans are to adjust the offer for large merchants and relaunch the promotion campaign in this segment.

New feature in the beGateway back-office: transaction logs

The eComCharge team has launched a system for finding and displaying server transaction processing logs for its customers: every PSP, running on the beGateway platform, in their back-office now has access to a log of requests and responses between its leased processing system and the acquiring banks with which it works.

“Each of our customers has received an opportunity to view the logs of communication between its processing system and acquiring banks on the transactions of interest to them in a back-office of the leased online payments receiving and processing system, without recourse to our Technical Support,” comments the Chief Product Officer of eComCharge UAB, Alexander Mihailovski. Read more…

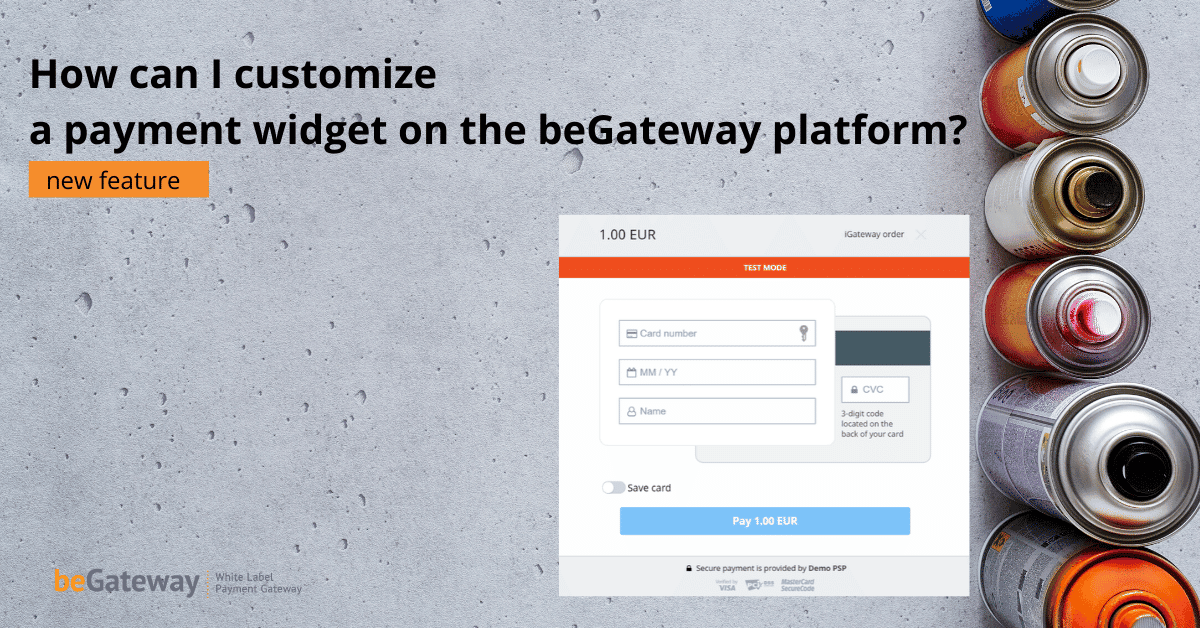

How can I customize a payment widget on the beGateway white label payment platform?

Last year, we announced our new payment widget with 3-D Secure inside for the tenants of the beGateway white label payment gateway solution. One widget to combine all payment means for a merchant to receive payments.

To see a basic widget and to view how it works, please visit our page “Payment widget“: Read more…

Setting limits on transactions. Recommended or required for a processing company?

Setting limits on transactions to be processed so that the business of the processing company could be successful does sound strange to third-party people. It would seem that the more transactions the payment service provider processes, the bigger the commission it will receive from the customers. And the limits seem to hinder the growth of the business of the payment company. Nevertheless, the system of limits is part of the control over the transactions performed by the processing company and serves as an important means of maintaining stability and security of the business.

Usually, online merchants do not know it, but international payment systems (VISA, Mastercard and others) recommend payment service providers to limit the number of accepted payment transactions carried out using the same bank card through the same merchant account (i.e. online store or mobile application) within one day. These recommendations vary depending on the type of online business. Read more…

What do I need to know about financial institution licenses for Payment Service Providers?

For a payment company, PI or EMI authorization today means months of expectations. We talked to the customers of eComCharge (white Label Payment Gateway tenants) who have already received European licenses, and who also await obtaining one in other jurisdictions, and here is a review for those who just thought about it. Naturally, it is not a very detailed one, as authorization requires a lawyer.

The most popular types of payment licenses in Europe

To date, European payment companies covet one of the two authorization types relating to the Financial Institution and issued under the PSD2 regulation: PI (Payment Institution) and EMI (Electronic Money Institution). Read more…

Anti fraud management system and tools for the white label payment gateway beGateway

The importance of anti fraud management system and fraud protection tools to protect online sellers from fraudulent payments in e-Commerce is huge. Unlike traditional trade, the Internet merchant accepting payments over the Internet can only hope that the person on the other side of the monitor is indeed the owner of the bank card and a conscientious buyer.

The payment data that the buyer enters on the payment page of the online store or mobile application is easy to steal, copy and use. To protect against fraudulent transactions, white label payment gateway beGateway offers its tenants three integrated fraud protection tools. Moreover, we also offer a possibility to connect any third-party instrument at the request of the payment service provider. Read more…

White Label Payment Processing Platform: review of the new payment widget with 3-D Secure check

eComCharge developers released a new payment widget for the white label payment processing platform beGateway with the ability to pass 3-D Secure check in the widget. Here are the advantages beGateway tenants and their clients gained.

A payment widget is a payment form opened on the website in an iframe to keep a visual contact of the online buyer with the website on which they pay for a product or service, without redirection to the page of the electronic payment processor. Read more…

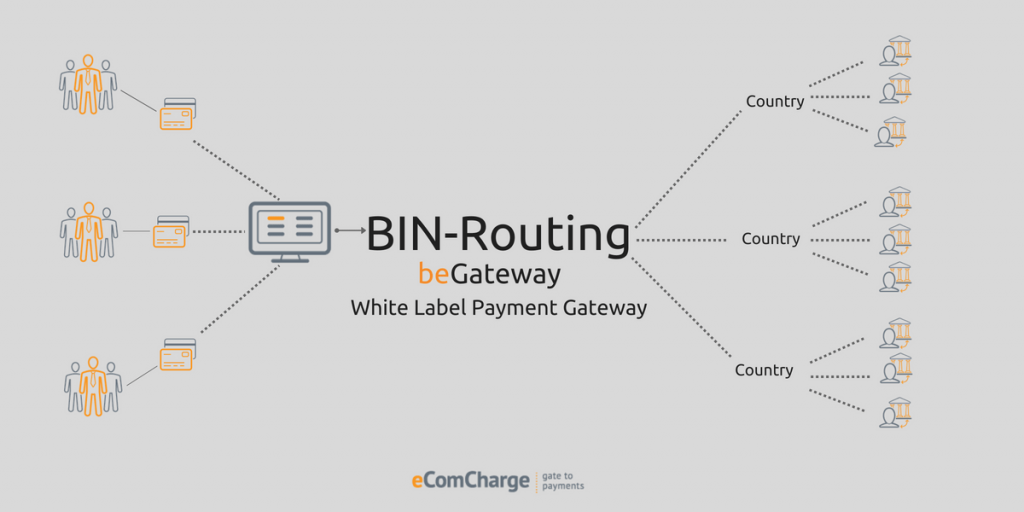

How will BIN-routing reduce cost for white label payment gateway tenants?

In the summer of 2018, the eComCharge team has enhanced its SaaS white label payment platform beGateway with another functionality. We have added BIN-routing – automatic routing of card transactions to the desired acquiring bank depending on the card BIN (Bank Identification Number). This functionality is part of SMART-routing which the team is planning to implement in the near future.

Thanks to the new functionality, the cost of Internet acquiring for the tenants of the white label payment gateway has decreased on average by 0.6%. It is because processing companies can now direct payment card transactions for processing to the acquiring banks for which these transactions are Intraregional, Domestic or even On-us. Read more…