When arranging for any business to accept payments over the Internet (all administrative matters settled, customer questionnaire filled out, all required documents provided, and a contract for rendering payment services signed), there comes the final step – launching technical interaction between an online store, a website or a mobile application and a payment service provider’s processing system (i.e. your rented payment processing software).

This is what programmers call integrating an online merchant’s resource with a processing system. And those who are no IT professionals simply call “adding a PAY button”.

In any case the result is a connection of the internet store, a mobile application and so on to the processing system of the payment service. That lets buyers choose the most convenient method of payment, and enter their payment details safely etc. And lets merchants accept payments over the internet for their goods or services, get protection against possible fraudulent transactions, and many other perks, that make accepting money via the internet as easy and convenient as accepting cash at a regular store.

Integration options: integrating an online store with the payment processing software (system) of a payment service provider

Modern processing systems, as well as beGateway white label payment gateway, offer 3 integration options:

-API integration.

-Redirecting to the processing company’s payment page

-Integration with the payment form displayed in iFrame.

API integration

API stands for Application Programming Interface.

API is a set of requests and responses, using which the processing platform of a payment service provider can communicate with external source (online store, mobile application, etc.).

Using API integration, an online merchant can put in place interaction between their resource and the processing system of a payment service on the so-called low server-server level.

This integration enables the seller to arrange the process of accepting payments from their buyers the way their business needs.

For example, the process can be split into several stages. Or, a merchant can create and fully control a payment page or a payment form for the buyers to enter their payment information.

Having full access to billing data, a merchant can store it for later use.

Simply put, API integration gives the seller the greatest freedom of action when accepting payments.

But choosing API integration with a payment service, the online merchant should be aware of two things:

- API is the developer’s tool. Accordingly, API integration is always associated with programming, no matter how simple the API is.

- If the Internet merchant is going to accept bank cards, they are to go through complex PCI DSS certification, to comply with the safety requirements of the payment industry, and get the right to access and handle the customer’ personal card data?

API integration is often used by very large Internet merchants with complex systems of online stores, or when for some reason there are no other options of connecting to the processing system of the payment service provider.

API of a payment service processing system should have two important properties:

- Firstly, API should give full access to all the tools and features of the platform for payment acceptance and processing.

- Secondly, the API should be simple enough so that even a novice programmer could work with it.

For example: here are formats and examples of API requests and responses of the processing platform named beGateway.

Redirecting the buyer to the processing company’s payment page

This is the most popular and the most commonly used way to integrate any resource that requires online payment acceptance, with the processing system of a payment service provider.

In general, this is the “PAY” button for the Internet store or mobile application that the merchants ask for, if they don’t wish to mess with programming.

The truth is that you can’t avoid working with the program code completely. But usually, it all boils down to simple copying the ready-made code from the documentation for integration with the processing system to the merchant’s web-site.

As a result, the PAY button appears on the merchant’s web site or any other resource. By pressing this button, the buyer goes to a secure payment Web page physically based on a secure server of a payment service provider.

While entering his or her payment details on this page, the buyer can be confident that the data will not be compromised, because the payment page itself, and processing system which provides it comply with the strict security requirements of PCI DSS, which is a must when working with payment cards.

This is the essence of integration with redirecting a buyer to the processing company’s payment page– to free the Internet merchant from having to deal with complex issues related to the secure use of payment data of their customers. The merchant doesn’t even have to think about it. The payment service provider does everything for him!

The payment page is part of the processing platform. Depending on the platform, a payment page might have some additional useful features.

- For example, in beGateway the payment page switches automatically to a mobile version, if a buyer opens it with a smart phone or a tablet;

- Besides online payments by credit cards, the online-merchant can also accept alternative means of payment (bank transfers, e-wallets, prepaid vouchers, etc.).

- The merchant can choose the input fields to be shown to the buyer, i.e. how much information the buyer should provide for the payment to be made. For example, when one pays by card, there should be at least the card number, CVC, expiration date and buyer’s email address.

Integration examples when a buyer is redirected to beGateway payment page.

Payment form in iFrame

iFrame is an area of a Web browser window, dedicated to a specific task.

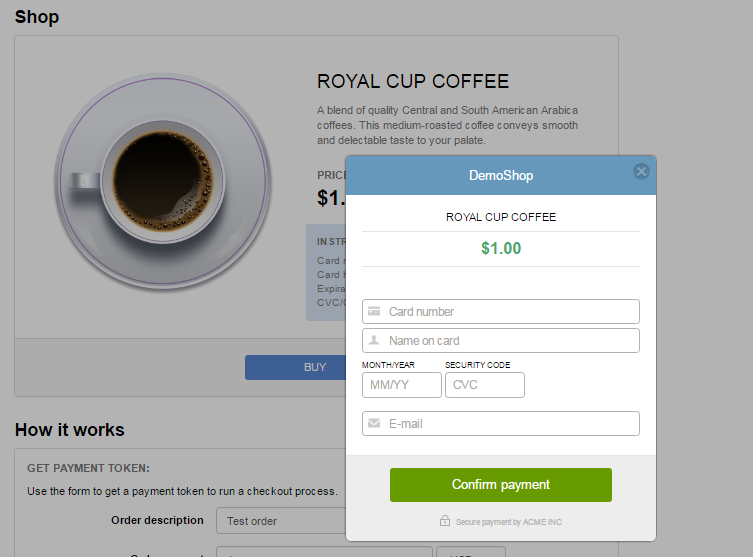

Accordingly, the payment form in iFrame is a form displayed to the buyer in a separate window with the background of the online store web site. It looks like “picture in picture” function in modern TVs.

This method of integrating a Web resource with the processing system of a payment service provider is the evolution of the idea of providing an online business with a ready-made secure payment page to receive money from buyers and customers. It is preferred by online shops, because this type of integration allows buyers to pay without losing visual contact with the Web site of the online store.

It looks as follows:

When the buyer clicks on the “pay” button in the online store, in the same browser window there opens an iFrame with the payment form. At the same time, the area of the browser window behind the iFrame dims automatically not to distract the buyer from the payment process.

The special technology used in this integration version ensures that the input data is accepted and transmitted securely to the payment service provider processing system in compliance with all requirements of the previously mentioned PCI DSS.

When the payment is complete, iFrame disappears, and the online store web site becomes active again.

Due to the fact that it all happens in one browser window without having to go from one website to another to pay, the buyer considers the payment form in iFrame an integral part of the online store. This decreases fears and increases the buyer’s confidence in the payment process.

Still, for the payment form in iFrame to look an authentic part of the online store, beGateway processing platform allows online merchants to customize iFrame using CSS.

Examples of setting up the payment form in iFrame by beGateway you can find here.

Generally, using one’s own White Label payment gateway platform as the basis of your business for payment accepting and processing, allows any payment service provider to not just offer modern ways of connecting to the payment service, but also to significantly reduce their own expenses on processing system maintenance.

For example, beGateway payment processing software is available as SaaS and can be rented. While the 24-hour monitoring of the platform, maintenance, development and annual PSI DSS certification is carried out by and at the expense of eComCharge, the developer company. The only thing left for the payment service is to focus on attracting new customers.