So you’ve decided to engage in the business of accepting online payments (to start a payment processing company). The demand for online payment acceptance and processing is growing steadily worldwide. The market is expanding thanks to the constant flow of commercial, non-profit and government organizations selling their goods and services online. Thus the market creates enough space for successful and profitable activity, not only for major payment processing companies, but also for beginners. It is especially true for emerging markets, while they are not yet occupied by major payment service providers.

While the motivation to create a payment service is no problem, there may appear quite a few questions on where to actually start a business of online payment acceptance and processing.

Having 13 years of experience in managing and creating payment systems and services, our company decided to create an instruction for beginners with basic steps to start a payment business. In fact, this instruction covers all frequently asked questions start-ups usually ask us.

How to start a payment processing company. Part 1. What means of payment to work with (integrate).

There are a number of payment means in the world to pay for goods or services via the Internet. Electronic money, cryptocurrency, prepaid vouchers, SMS payments, bank transfers, electronic checks and, of course, bank payment cards are the most popular means of payment used with a certain activity rate for transferring money from Internet buyer to Internet seller.

A Payment Service Provider that helps online merchants accept payments via the Internet, charges either a flat fee for each transaction, or a certain percentage of its amount, or both. Accordingly, the more transactions the payment company handles, the more money it earns.

A beginner payment service provider (payment processing company) might want to start with offering their potential customers to accept online payments made with the payment means most common in the countries the payment service plans to provide services to.

The popularity of each means of payment varies from region to region and from country to country. There are global leaders virtually equally popular worldwide. And there are local payment instruments, holding the second, or sometimes the first place in the preferences among buyers and sellers of a certain country.

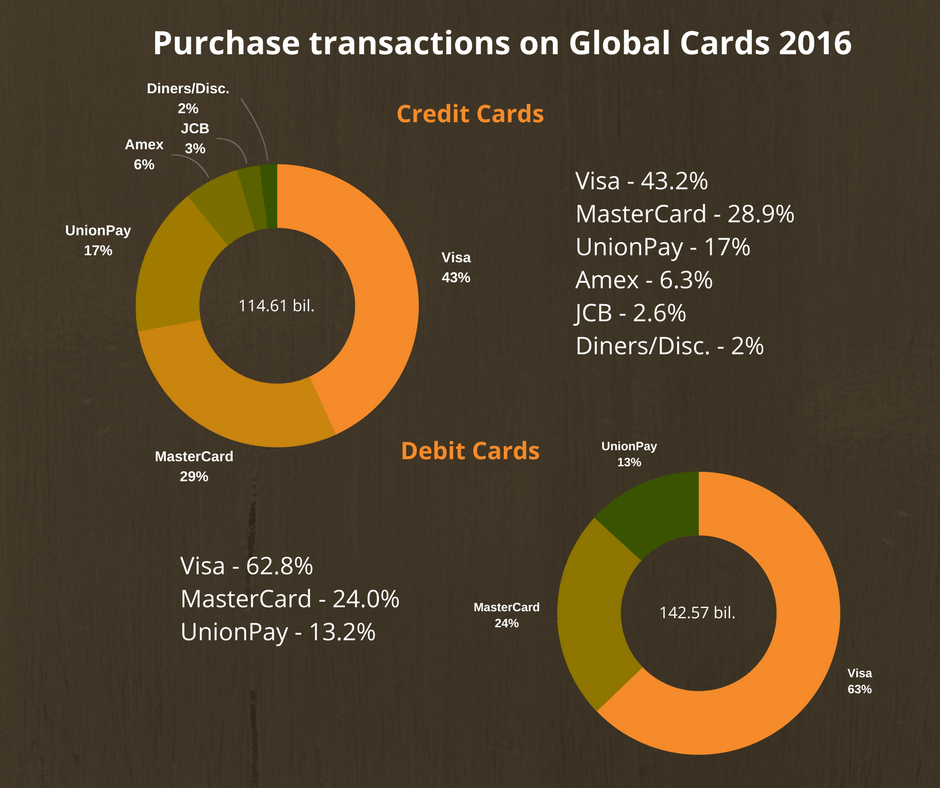

According to the Nilson Report, May 2017/issue 1109 Visa, Union Pay, MasterCard, JCB, Diners Club/Discover and American Express brand general purpose cards generated 257.17 billion transactions at merchants in 2016. These transactions include all commercial and consumer credit, debit and prepaid products. Debit figures shown here include prepaid cards. Visa cards include Visa Inc. and Visa Europe, which became a single company in June 2016.

Globally, bank credit cards, particularly VISA and MasterCard, are the leaders.

EcommerceWiki Report, based on several sources including publications by Payment Service Providers, news websites and ecommerce shopping associations, gathered the most relevant payment means in Europe:

Table 1. Payment means in Europe

| Country | Relevant payment means |

| Netherlands | 1. iDEAL (local alternative payment method – simplified online bank transfer (SCT)) – 56% marketshare 2. Credit cards (1. MasterCard, 2. Visa, 3. American Express) – 12% |

| Belgium | 1. Bancontact/MisterCash (local alternative payment method – simplified online bank transfer) – 32% 2. Credit cards (1. Visa – 30%, MasterCard – 20%, American Express – 2%) 3. Online Banking: KBC/CBC Online, ING Home’Pay and Belfius Direct Net, SOFORTBanking – 8% |

| Luxembourg | 1. Credit cards (1. Visa, 2. MasterCard) 2. PayPal 3. SEPA direct debit 4. SEPA credit transfer (regular Bank Transfer)

|

| France | 1. Local debit/credit cards – Carte Bancaire, e-Carte Bleue (both co-branded Visa or MasterCard) 2. Credit cards (1. Visa, 2. MasterCard, 3. American Express) 3. PayLib (eWallet) 4. PayPal |

| Germany | 1. ELV (SEPA direct debit) 2. Credit cards (1. Visa, 2. MasterCard, 3. American Express) 3. PayPal 4. SOFORTbanking (online bank transfer) 5. Giropay (online bank transfer) |

| United Kingdom | 1. Credit cards – 1. Visa (dominant 70-80%), 2. MasterCard, 3. American Express 2. Debit cards – 1. Visa Debit, 2. Maestro 3. PayPal 4. Bank Transfers |

| Italy | 1. Cartasi (local credit card co-branded with Visa or MasterCard) 2. PostePay (visa co-branded card) 3. MyBank (online bank transfer, multiple banks participating) 4. Credit cards (Visa, MasterCard, American Express) 5. PayPal |

| Austria | 1. EPS e-Payments (internet banking transfers, multiple banks participating in one scheme) 2. Credit cards (Visa, MasterCard, American Express) 3. PayPal 4. SEPA Credit Transfer (regular Bank Transfers) 5. SEPA Direct Debit 6. SOFORTbanking |

| Denmark | 1. Dankort (debit card) 2. Credit cards (Visa, MasterCard, American Express) 3. Pay-by-Links (bank transfers initiated through payer’s personal internet banking environment (if supported by bank) 4. PayPal 5. Klarna |

| Finland | 1. Pay-by-Links (bank transfers initiated through payer’s personal internet banking environment (if supported by bank) 2. Credit cards (Visa, MasterCard, American Express) 3. Klarna 4. PayPal |

| Ireland | 1. Credit cards (Visa, MasterCard, American Express) 2. PayPal 3. SEPA Credit Transfer (regular Bank Transfers) 4. SEPA Direct Debit |

| Norway | 1. Credit cards (Visa, MasterCard, American Express) 2. Bankaxess (internet banking transfers, multiple banks participating in one scheme) 3. PayPal 4. Bank Transfers 5. Klarna |

| Sweden | 1. Credit cards (Visa, MasterCard, American Express) 2. Bank Transfers 3. Klarna 4. PayPal |

| Portugal | 1. MultiBanco (offline, ATM-based payment method) 2. Payshop (offline, ATM-based payment method) 3. Credit cards (Visa, MasterCard, American Express) 4. PayPal 5. SEPA Credit Transfer (regular Bank Transfers) |

| Spain | 1. Credit cards (Visa, MasterCard, American Express) 2. Pay-by-Links (bank transfers initiated through payer’s personal Internet banking environment (if supported by bank) 3. Trustly (overlay online bank transfer service) 4. PayPal |

| Switzerland | 1. Credit cards (Visa, MasterCard, American Express) 2. SOFORTbanking 3. PostFinance Card (Debit card) 4. Bank Transfers |

| Bulgaria | 1. Credit cards (Visa, MasterCard, American Express) 2. PayPal 3. Bank Transfers 4. Others (paysafecard, bitcoin, …) |

| Croatia | 1. Credit cards (Visa, MasterCard, American Express) 2. PayPal 3. Bank Transfers |

| Czech Republic | 1. Credit cards (Visa, MasterCard, American Express) 2. Pay-by-Links (bank transfers initiated through payer’s personal internet banking environment (if supported by bank) 3. PayPal 4. SEPA Credit Transfer (regular Bank Transfers) |

| Lithuania | 1. Credit cards (Visa, MasterCard, American Express) 2. Pay-by-Links (bank transfers initiated through payer’s personal internet banking environment (if supported by bank) 3. PayPal |

| Hungary | 1. Credit cards (Visa, MasterCard, American Express) 2. Pay-by-Links (bank transfers initiated through payer’s personal internet banking environment (if supported by bank) 3. PayPal 4. Bank Transfer |

| Estonia | 1. Credit cards (Visa, MasterCard, American Express) 2. Pay-by-Links (bank transfers initiated through payer’s personal internet banking environment (if supported by bank) 3. PayPal 4. SEPA Credit Transfer (regular Bank Transfers) |

| Latvia | 1. Credit cards (Visa, MasterCard, American Express) 2. Pay-by-Links (bank transfers initiated through payer’s personal internet banking environment (if supported by bank) 3. PayPal 4. SEPA Credit Transfer (regular Bank Transfers) |

| Poland | 1. Credit cards (Visa, MasterCard, American Express) – Installments needed for maximum conversion 2. Pay-by-Links (bank transfers initiated through payer’s personal Internet banking environment (if supported by bank) 3. SOFORTbanking 4. PayPal |

| Romania | 1. Credit cards (Visa, MasterCard, American Express) 2. Pay-by-Links (bank transfers initiated through payer’s personal internet banking environment (if supported by bank) 3. PayPal 4. Bank Transfer |

| Slovenia | 1. Credit cards (Visa, MasterCard, American Express) 2. Pay-by-Links (bank transfers initiated through payer’s personal internet banking environment (if supported by bank) 3. Bank Transfer |

| Ukraine | 1. Credit cards (Visa, MasterCard, American Express) 2. Pay-by-Links (bank transfers initiated through payer’s personal Internet banking environment (if supported by bank) 3. QIWI (wallet) 4. Bank Transfer |

| Iceland | 1. Credit cards (Visa, MasterCard, American Express) 2. PayPal 3. Bank Transfers |

Brazilian shoppers prefer to pay for their products with card installments and boleto, the majority of Turkish shoppers pay by credit card and most Belgium shoppers pay with their local payment brand Bancontact/MisterCash.

Please, note, that payment preferences and payment method market share may change over time. There will be new online payment methods and solutions that could rapidly gain market share payment preferences and shares can differ per individual online seller and industry, even when targeting the same country (e.g. gambling, insurances).

To begin with, a payment service provider might want to offer their customers to accept payments using VISA and MasterCard bank payment cards, plus one or two of the most popular local payment methods.

In the next part of the instruction, we will discuss business models of this sphere.