Accounting and reports are essential for any business; they arrange for sustainable development and success. Accounting allows you to be aware of the relevant data on the current state of affairs in the processing platform at any point. A report turns this data into information easy to read and understand.

Statistical reporting on the processed transactions is an important and indispensable tool for companies providing online payment accepting and processing services.

It allows you to keep your finger on the pulse of transactional flows of your online merchants, track emerging and evolving trends in the operations of the processing system, the company and its customers, and ultimately helps to make the right decisions at the right moment.

Our team focused on making the reporting tools both simple and effective while developing the processing platform beGateway.

Flexibility is the word that accurately describes the processing platform beGateway in general and its possibilities for creating statistical reports about transactions in particular.

No one can predict what kind of report a payment service provider might need today, tomorrow, or in a week. It means that setting parameters of the statistical report should be flexible enough, so that a processing company employee could easily get:

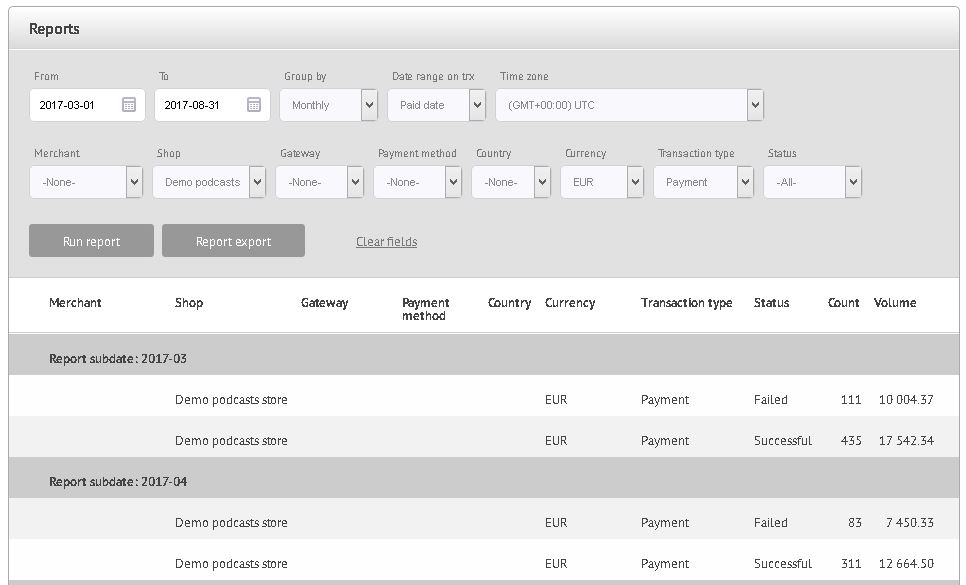

1. General information on the processing history of a certain online store over the past six months: the number and amount of successful and rejected payment transactions, refunds and chargebacks, organized by the month;

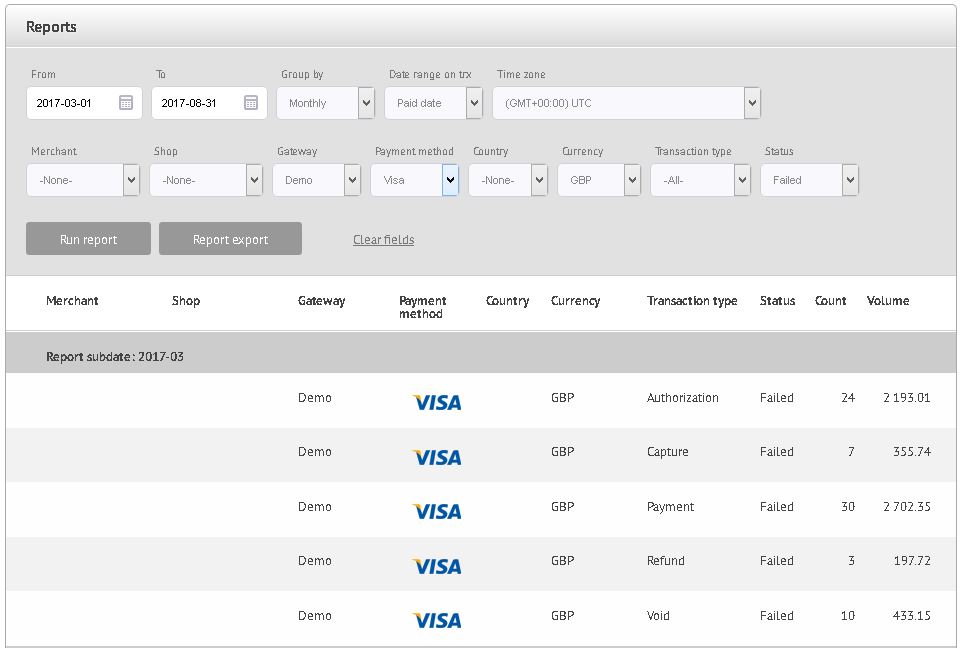

2. Detailed information about all the transactions that have passed through the processing system in the current quarter: the number and amount of successful and rejected transactions of each type (authorization, capture, payment, refund, chargeback, payout etc.), grouped by the acquiring partners with further division by type of payment (e.g.,VISA, MasterCard, Amex, etc. for cards) and the transaction currency.

Our team has developed such an engine and made it part of the user interface of the platform beGateway.

Look inside beGateway processing platform

The tools for creating statistical reports on transactions are to be found in the “statistics” section in the back office of beGateway user.

You can grant or deny access to this section to any employee depending on need and their official duties. It’s a sensible precaution. As information on transaction flows processed by the payment service processing system may be confidential, not everyone in the company should have access to it.

To get the requested report, you should somehow explain to the report processing system what exactly it should contain. In computer terms, a statistical report is the result of data selection and grouping according to specified grounds, and in the specified order. So all you need to do is describe the criteria of the transactions to be used to create the desired report, and indicate how the information should be grouped. To do so, we offer our clients to use the filters.

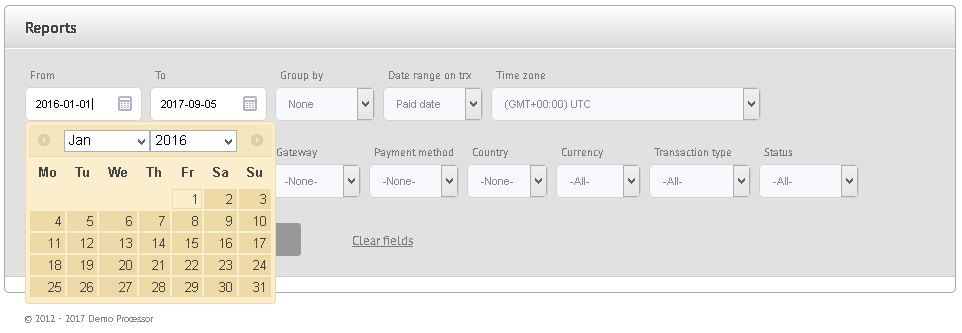

First, you need to select the period for the transaction data. The period is specified in the filter “time line”, which consists of two conventional calendars, where you choose the start and the end dates of the future statistical report.

If the value of the “time line” is not set, the processing platform beGateway creates the report, starting with the first transaction processing date, and ending with the most recent processing date. Here next to the filter “time line”, you can select one of the two options for displaying information in a report: by the day or by the month. If not specified, the report will show a generalized information for the entire period.

Once the period for the report has been selected (or not, – it’s up to you), it’s time to set the remaining characteristics of transactions that should be included into the statistical sample.

Every transaction has many different characteristics. For example, the processing platform beGateway is able to monitor and control more than 40 parameters, to ensure safety of payment accepting.

But for statistical purposes this would seem excessive. We conducted a survey and consulted our clients from among payment services that already lease beGateway and use it as a processing system for their business. As a result, we added 7 more parameters to the filter “time line”:

– Gateway – to select the acquiring partner to whom the transaction was sent for final processing, or from whom it was obtained, in case of a charge back.

– Merchant – to select an Internet merchant, to whom the transaction belongs.

– Shop – to select the respective merchant’s online store.

– Payment method – to select the payment type of the transaction.

– Currency – to select the currency of the transaction.

– Transaction type – to select the type of transaction.

– Status – to select the status of the transaction.

All of these filters are drop-down menus for selecting one of the available values. By selecting different values for these filters and combining them, you can create virtually any statistical report on the processed transactions.

More opportunities

We implemented something like hierarchical dependencies for all filters in beGateway statistical reporting system for greater convenience.

Simply put, we have arranged for the contents of the drop-down menu of each successive filter to change dynamically depending on the value of the previous one:

If, for example, you select the period from January, 1st to 31st in the “time line” filter:

- the “Gateway” filter will show only the acquiring partners through whom the transactions have been carried out in the specified period of time;

- the “Merchant” filter will show the online sellers who have had at least one transaction or made a transaction attempt in the specified period, etc.

If you select a specific acquiring partner in “Gateway”, the “Merchant” drop-down menu will contain only the merchants who are connected to the specified acquiring partner, and have at least one successful or declined transaction over the period from the 1st to 31st of January.

In addition, the same transaction parameter filters can be used to change the level of detail of statistical reports.

For example, depending on the selected “Payment method” filter values:

- You can create a report that will show the total number and amount of successful payment transactions for a certain merchant;

- or, you can create a report where the information will be decomposed into components, displaying the number and amounts of successful payments for each type of payment means – VISA, MasterCard, Amex, etc. – accepted by the Internet seller.

Do you want to convert all transactions to the same currency? It’s easy!

Finally, there is another interesting feature in drawing up statistical reports with beGateway platform. Using the filter “Currency”, among other things, you can create a report with all the original currencies converted into one. Yes, the processing platform beGateway can keep track of daily quotes!

The statistical report can be exported to MS Excel file format. In addition, if needed, you can export a page with a detailed list of all transactions the report was based on to MS Excel too.

What reports do your merchants make?

Statistical reporting system for a processing company in beGateway is so practical and user-friendly that it was added to the merchant’s back office with some minor changes (appropriate restrictions on transaction samples).

However, we made some nice improvements here too. At the request of our clients – processing companies, – now all Internet merchants connected to the payment services based on the platform beGateway can create statistical reports in which all proceeds received by the online store over the Internet are divided by the country of origin, with indication of the number and total amount of payments for each country. EU countries can be selected separately.

This makes it much easier for EU online merchants to calculate VAT, after the amended legislation of this geopolitical bloc ruled to require the VAT payment by the country of the buyer.