How does financial reporting module work in the white label payment platform? Look inside beGateway processing platform.

All companies that help online businesses receive money from customers over the Internet fall into two large groups: payment gateway and payment aggregators.

The first group are purely technical companies that offer advanced technologies and everything else an Internet merchant needs for receiving secure online payments.

The second group offer both the technologies and the financial service: they accept payments on behalf of their clients, accumulate incoming money on their own bank accounts and make independent settlements with Internet merchants on all processed transactions.

Such operations entail more responsibility and more work for a payment aggregator. As they should regularly, accurately and carefully do the following:

- Prepare financial statements to make payments to the online merchants;

- Keep record of funds for each of their online stores;

- And control payout details: to whom, when and on what transactions the payment was made.

This is hard work for accountants, even if the payment service provider that specializes in payment aggregation for e-commerce is relatively small. And most importantly, this work needs to be done over and over again, as often as the payment aggregator makes payments to their customers.

But the good news is that all this computing, accounting and control can and should be automated. Which we accomplished, by adding financial reporting module to beGateway, our white label payment platform, specifically for payment service providers.

How does financial reporting module work in the white label payment platform?

In the processing platform beGateway, you can set the values of the “Buy rate” and “Sell rate” fields for each type of transaction – authorization, capture, payment, refund, chargeback and payout.

The “Buy rate” is the percentage taken by the payment service provider’s acquiring partner to whom the transaction is sent for final processing: the acquiring bank, e-wallets, etc.

The “Sell rate” is the percentage taken by the payment service provider from an online merchant for transaction processing.

The difference between the “Sell rate” and the “Buy rate” is the payment service provider’s revenue.

The “Buy rate” and the “Sell rate” are set individually for each online store, for each means of payment (which online seller plans to process via the payment aggregator processing system) and for each currency.

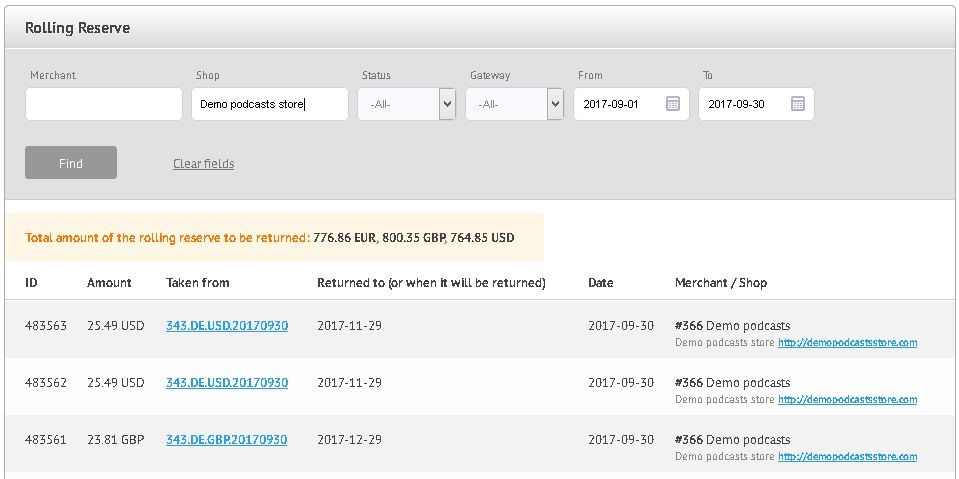

Besides tariffs for each means of payment, in beGateway, you can also set the value of the “Rolling reserve” field.

The “Rolling reserve” is a security deposit, calculated as a certain percentage of each payment transaction amount and held back by the payment service provider within a specified time before giving it back to the Internet retailer. The hold back period of the “Rolling reserve” is set in days next to its amount.

Every day, or more precisely every night at midnight the processing platform beGateway accomplishes what we call “closing the online store trading day”. Financial statements module in the beGateway platform works with all the online stores connected to the processing system of the payment service provider and performs the following operations for each online store:

- Collects all transactions from 0:00 to 11:59 pm of the previous day;

- Re-calculates insurance deposits;

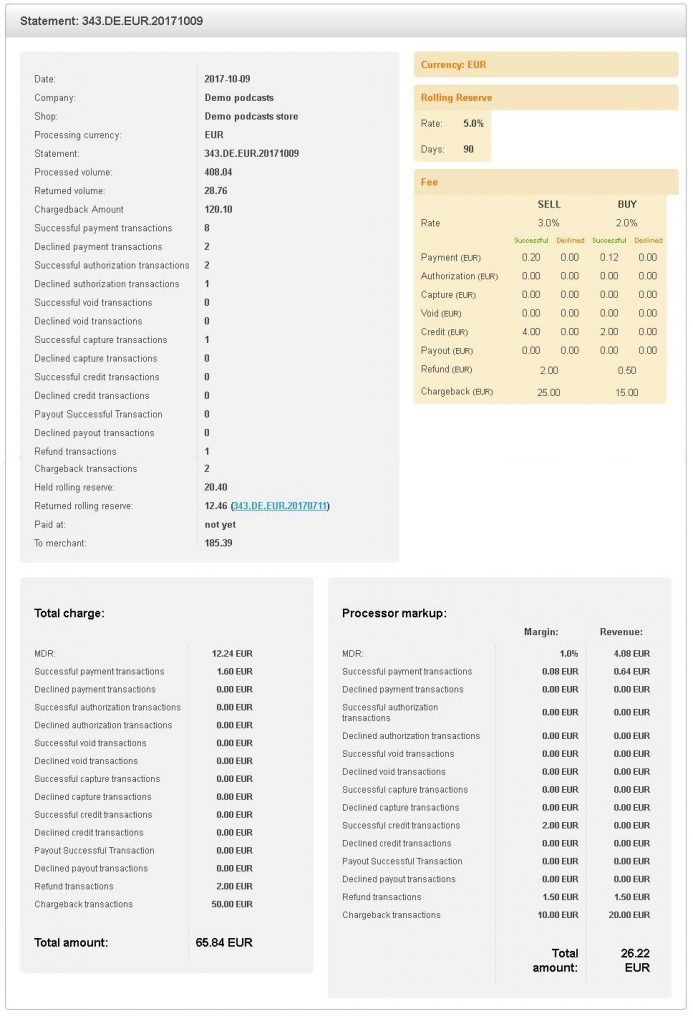

- Automatically draws up a financial statement on the previous day results that contains the following information:

- The total number, the amount and the currency for each transaction type for each means of payment.

- The values of the “Buy rate” and “Sell rate” for each type of transaction and the amount resulting from the application of these tariffs.

- The security deposit amount withheld by the processing company as the result of the operational day.

- The security deposit amount returned to the online store, if one has been previously withheld and the hold back period has already expired.

- The amount due to the Internet merchant at the end of the day.

- Payment service provider’s revenues.

The financial report is drawn up in each currency accepted by the online store.

You can view financial statements and work with them in your back office in the “Payout” section. You can enable or disable access to this section to any employee of the payment service based on their official duties.

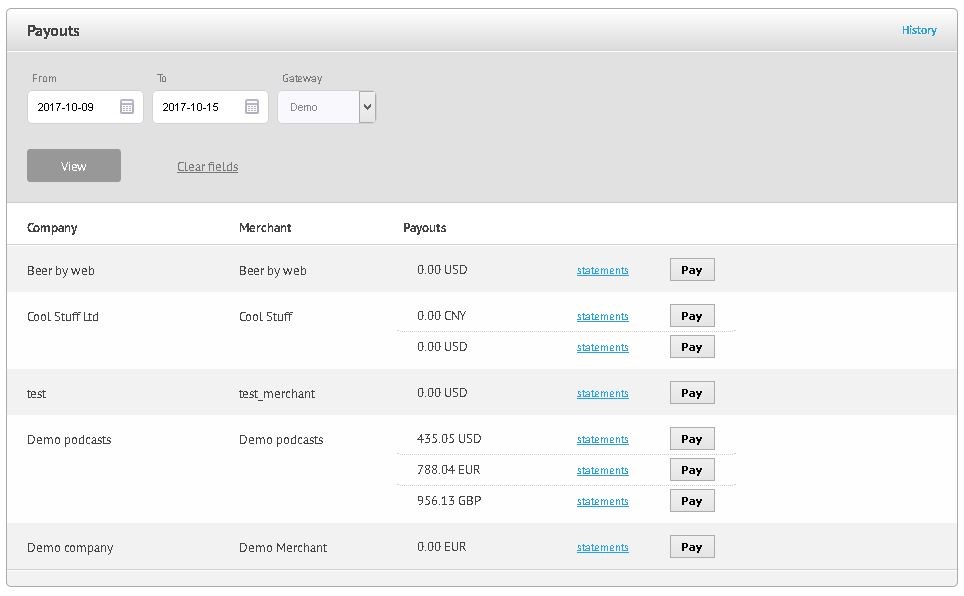

The main purpose of the “Payout” section is to organize payout for the processed transactions to the Internet merchants of the payment service. Given that different payment service providers have different periodicity of payments (and sometimes have to pay sooner or later than the usual term) in beGateway, we have developed a simple, flexible and effective mechanism to enable payment service provider’s accountants to obtain the information necessary to calculate the settlement amount for their Internet merchants at any time.

On the payout day, the accountant of the processing company (using the time filter of the “Payout” section) sets the first and last day of the pay period of the settlement to the online merchants for their transactions.

On applying this filter, the processing platform beGateway creates a register of payments, in which the total amount payable for the selected pay period is indicated, as well as the list of financial statements the amount was based on.

In fact, the total amount to be paid is nothing but the sum of amounts due to the Internet seller at the end of the day, based on the daily financial statements for all their stores.

If the Internet merchant accepts payments in several currencies, the payable amount will be indicated for each currency individually.

Next to each payable amount in the registry there is the “Paid” button. It i used to “cancel” financial statements if the payment has already been made. After clicking it, all financial reports used in calculating the final amount to be paid for the pay period are marked as “paid”, besides, the date and time are specified. So you can always see which financial statements have been “canceled”, meaning that the money have been sent to the Internet merchant, as well as the date of the payout. Moreover, it’s impossible for the “canceled” statement to appear in the next calculation of due amount.

In addition to payments made to the Internet merchants, this section contains information on the current security deposit amount, both for an individual store and for all stores connected to the processing system. Moreover, you can obtain the details both as of the current date and as of any day of the past period.

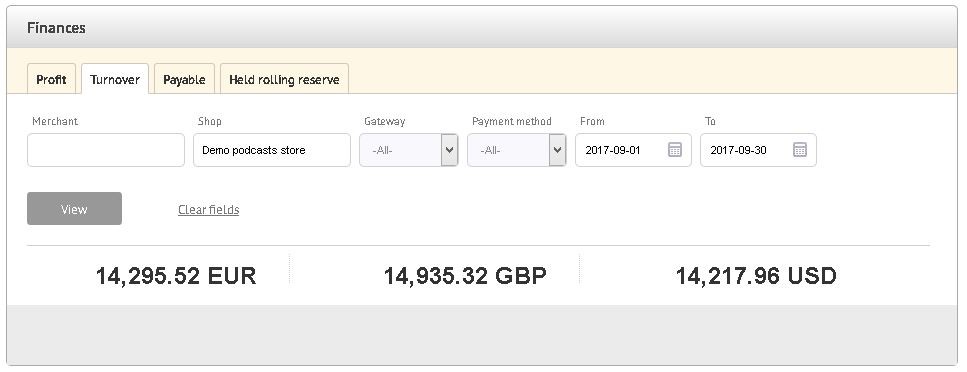

Besides, you can see statistics on certain financial performance indicators of the processing company for any period: revenue, total amount paid, due amounts, etc.

It remains to be added that if the payment service company leases the beGateway platform, the Internet merchants connected to the payment system can see the same financial statements, but in a somewhat abbreviated form (e.g., no “Buy rate” information, the payment service provider’s revenues).