Now, your internet merchants can not only decline a payment or submit high-risk transactions for additional verification, but also filter low-risk transactions, for example, by the amount, by the IP address (as identified by the merchant) and conduct these transactions without further 3-D Secure verification.

No doubt, this possibility eventually increases the conversion of the Internet merchants.

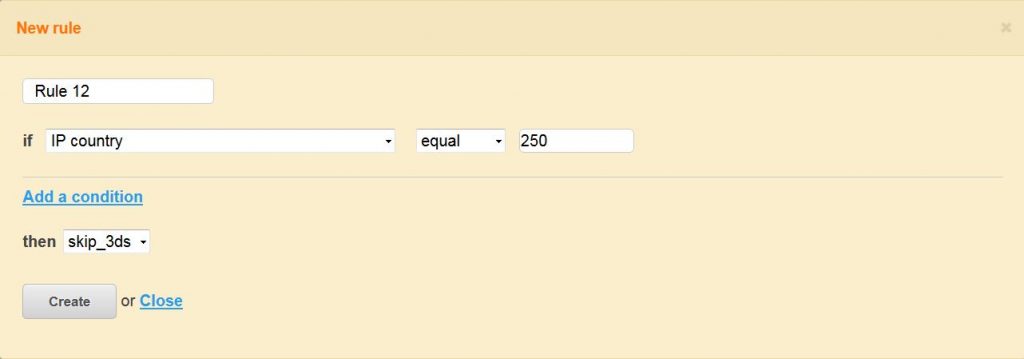

How to create a rule to skip 3-D Secure verification?

The rule is created in the beProtected system. The Internet merchant sets the parameters for the system to filter the transactions that must not undergo the 3-D Secure verification. At the end of the rule creation, the Internet merchant opts for “Skip 3-D Secure”. Thus, if a transaction matches the above settings, it is sent for authorization, bypassing 3-D Secure verification.

About beProtected (beGateway anti-fraud tool)

The beProtected system is based on safety rules and analyzes more than 30 parameters for each transaction in the course of payment: the buyer’s country, the IP address, the country of the IP address, the buyer’s email and phone number, the buyer’s name and even the digital device ID to identify the device used to make the payment. This information is stored in beProtected and is analyzed to find matching results for different customers and different transactions.

The processor of electronic payments and the Internet merchant can define which transaction must be either rejected and not processed, or accepted and processed but with a warning that the transaction must be carefully checked.

Contact us about how much our White Label card processing software lease will cost for you.

Best regards,